The Indian stock market, pulsating with potential, beckons investors with the promise of growth and prosperity. But amidst the excitement, one crucial factor differentiates successful investors from the rest: flexibility. And that’s where your Demat account becomes your secret weapon, offering a universe of customized options to tailor your investment journey to your unique needs and goals with the help of IRFC share price.

Breaking Free from One-Size-Fits-All:

Imagine buying a suit that doesn’t quite fit, pinching in some places and gaping in others. That’s what a generic Demat account feels like for many investors. They’re forced to navigate with tools and features that don’t align with their investment style or goals. But with customization, your Demat account transforms into a bespoke suit, perfectly crafted to empower your financial aspirations.

Unleashing the Spectrum of Possibilities:

The beauty of customization lies in its diversity. Here are just a few ways you can personalize your Demat account:

Investment Choices: Go beyond the conventional. Choose from a wide range of asset classes, including stocks, bonds, mutual funds, ETFs, and even IPOs, to create a portfolio that reflects your risk appetite and return expectations while considering IRFC share price.

Trading Frequency: Are you a day trader thriving on the thrill of short-term fluctuations, or a long-term investor focused on compounding benefits? Your Demat account can adapt. Select features suited to your trading frequency, from margin trading facilities to automated portfolio management tools.

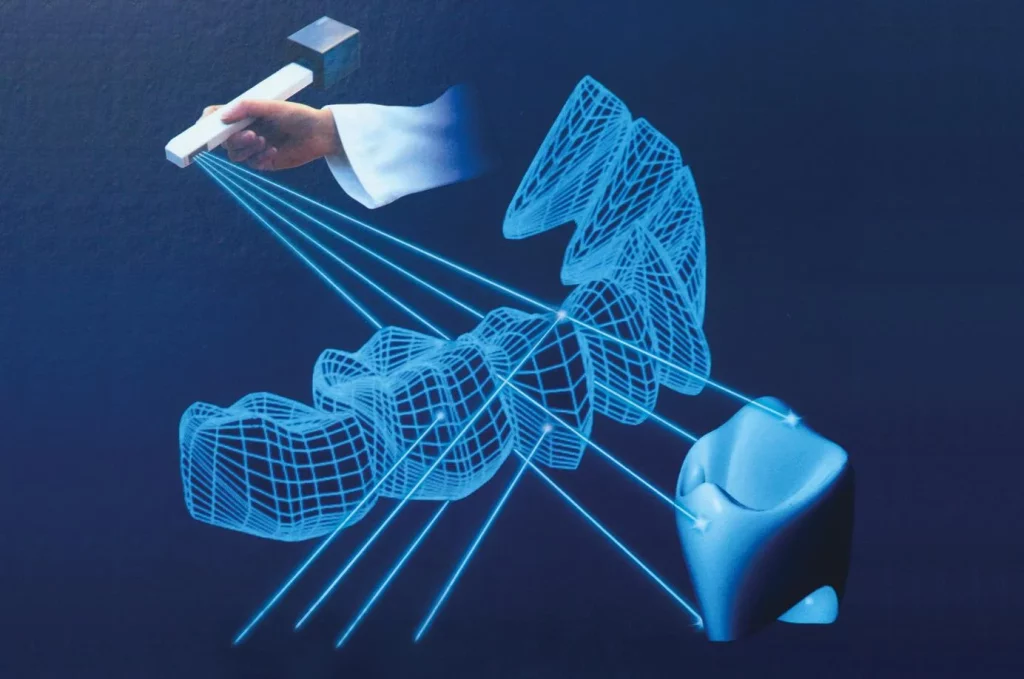

Technological Edge: Embrace the power of innovation! Integrate your Demat account with cutting-edge trading platforms, research tools, and even artificial intelligence-powered analysis to make informed decisions and stay ahead of the curve.

Risk Management: Don’t let volatility ruffle your feathers. Set stop-loss orders, configure alerts, and choose risk management tools that align with your tolerance for market fluctuations while checking the IRFC share price.

Cost Optimization: Every investor is value-conscious. Customize your Demat account to match your investment volume and frequency. Choose cost-effective plans and fees that ensure you maximize your returns without unnecessary expenses.

Finding Your Perfect Fit:

Customizing your Demat account isn’t a one-time event; it’s a continuous journey of optimization. As your investment goals and portfolio evolve, so should your account. Regularly evaluate your needs, explore new features offered by your DP or broker, and don’t hesitate to switch providers if necessary while knowing about IRFC share price.

Remember:

Research is key: Understand the different customization options available and their corresponding fees before making any changes.

Seek guidance: Consult with a qualified financial advisor to tailor your Demat account to your specific financial goals and risk tolerance.

Stay informed: Keep abreast of the latest advancements in Demat account features and technology to continuously optimise your investment strategy.

Conclusion:

A Demat account isn’t just a storage unit; it’s a powerful tool waiting to be unleashed. By embracing customization, you unlock a world of flexibility, empowering you to navigate the market with confidence and build a portfolio that truly reflects your unique investment personality. So, step into your Demat account, explore the possibilities, and craft your personal path to financial success, one customised feature at a time when you know about IRFC share price.